Discover the report global investors are using to rebalance their portfolios before the next wave of market disruption.

We’re living through the most financially complex period in decades — rising inflation, record debt, political dysfunction, and a market priced on momentum instead of value.

This report reveals how gold is reshaping modern portfolios — and why it may be one of the most critical assets to own in the next cycle.

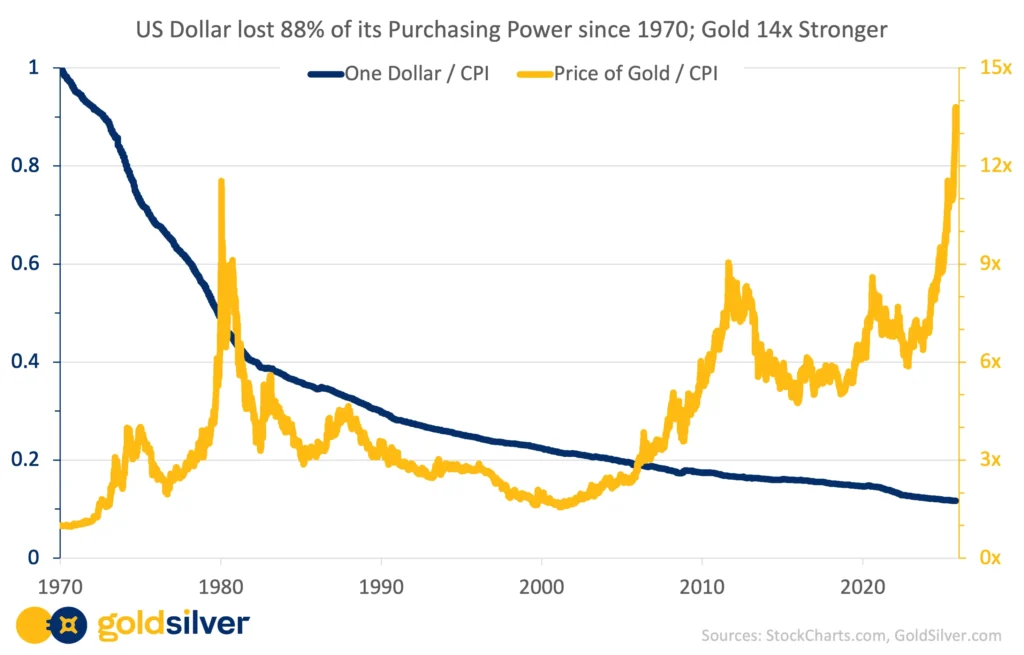

Since the U.S. abandoned the gold standard in 1971, every dollar saved has steadily lost purchasing power. What cost one dollar in 1970 now costs nearly nine.

Gold, on the other hand, hasn’t just preserved its value — it’s multiplied it. Adjusted for inflation, gold has risen more than fourteenfold since 1970, while the dollar has lost nearly 90% of its purchasing power.

The dollar’s decline is the inevitable result of inflationary policy.

Gold’s rise is the natural result of scarcity — and trust.

Gold is more than a commodity. It’s your portfolio’s insurance policy against the unknown.

Section 1: Sentiment Is Changing Around Gold

Discover how institutions, hedge funds, and individual investors alike are quietly repricing gold — and why Wall Street’s sentiment shift could mark the start of the next major bull market.

Section 2: The System Isn’t Safer

The financial system built on trust and debt is showing cracks. Learn why central banks, sovereign nations, and everyday savers are turning to gold as confidence in traditional “safe” assets fades.

Section 3: Why Gold Belongs in Every Portfolio

See decades of data showing how gold has outpaced inflation, balanced risk, and improved portfolio returns — even through crises like 2008 and 2020.

Section 4: The Modern Case for Gold — Performance and Correlation

Explore how gold’s role has evolved in modern markets — decoupling from outdated “interest rate” rules and emerging as a structural counterbalance to systemic risk.

Section 5: How Much Gold Is Enough?

From conservative to defensive portfolios, discover what 5%, 10%, or 20% allocations look like — and how the right mix can improve returns while lowering volatility.

Section 6: In an Uncertain World, Own What’s Certain

History’s lesson is simple: systems change, currencies collapse, and policies fail — but gold endures. Learn how owning real, tangible wealth provides the freedom and security no digital asset can match.

This report draws on GoldSilver’s 20+ years of market analysis, data from Bloomberg, the World Gold Council, the Silver Institute, and independent financial research platforms.

Every economic cycle ends the same way: the crowd realizes too late what the prepared already knew. This report gives you the clarity, context, and conviction to act before the headlines — not after them. Learn how to protect what you’ve built, position your portfolio for the next phase, and own what endures.